Endurance Warranty Review 2026: Is Direct Administration Better Than the Broker Model?

Last Updated: November 22, 2025 | 14 min read

When an Endurance warranty review search leads you here, you're likely researching whether this Illinois-based company—which markets itself as America's "#1 vehicle protection provider"—lives up to its promises. With nearly 20 years in business, over 500,000 customers, and industry awards from the likes of ConsumerAffairs and Inc. Magazine, Endurance presents a compelling case as a more evolved alternative to traditional warranty brokers.

But beneath the polished marketing lies a more complex reality: a $550,000 Oregon Department of Justice settlement for deceptive mailers, an active class action lawsuit alleging broken promises on claims processing, over 3,300 Better Business Bureau complaints in three years, and a fundamental question about whether "direct administration" actually solves the problems modern vehicle owners face with extended warranties.

This comprehensive Endurance warranty review examines the company's legitimate improvements over traditional broker models, analyzes the Oregon settlement and ongoing litigation, decodes their six-tier coverage structure, and explores why even "better than CarShield" doesn't necessarily mean "actually modern." Whether you're considering Endurance specifically or trying to understand the extended warranty industry's evolution, this analysis provides the complete picture you need to make an informed decision.

What Is Endurance Warranty? Understanding the Direct Provider Model

Founded in 2006 by entrepreneurs Paul Chernawsky and Jordan Batt, Endurance Warranty Services has grown from a startup with a mission to "change the extended warranty industry for the better" into one of America's largest vehicle service contract providers. Headquartered in Northbrook, Illinois, the company employs over 600 people and has protected more than 500,000 vehicles nationwide.

Endurance’s Market Position & Achievements

What Makes Endurance Different: The Direct Administrator Model

Unlike traditional warranty brokers such as CarShield (which sells contracts but outsources claims administration to separate companies like American Auto Shield), Endurance operates as a direct provider. This means they handle the entire process in-house:

- Marketing and sales - Customer acquisition directly through Endurance

- Contract administration - Endurance manages all policy details

- Claims processing - In-house team evaluates and approves claims

- Payment to repair shops - Direct payment without third-party delays

The Direct Provider Advantage: By eliminating the broker layer, Endurance theoretically reduces costs, speeds claims processing, and improves accountability. The company promises 48-hour claim approvals and emphasizes their ability to pay repair shops directly without waiting for third-party authorization. This represents a genuine improvement over the traditional three-layer broker model that dominates the industry.

Coverage Availability & Industry Recognition

Geographic Availability:

- Available in 48 states

- Not available in Massachusetts (strict insurance regulations)

- Special California mechanical breakdown insurance plans (meets state requirements)

Industry Awards & Recognition:

- 10+ Stevie Awards including Customer Service Department of the Year

- ConsumerAffairs Buyer's Choice Award 2025 - Best Coverage, Best Value, Best Customer Service

- Inc. 5000 Fast-Growing Companies - Listed 9 consecutive years (2015-2024)

- Chicago Top Workplace Award - Employee satisfaction recognition

Before examining the significant problems that led to regulatory action and ongoing litigation, it's important to acknowledge that Endurance has built a substantial business serving hundreds of thousands of customers. The question isn't whether they're legitimate—it's whether their "direct provider" model actually solves the problems that frustrate extended warranty customers, or simply relocates those problems within a more streamlined operation.

Sources: Endurance Warranty Official Website, Inc. Magazine Company Profile

The $550,000 Oregon Settlement: What the State Found

On December 28, 2022, the Oregon Department of Justice announced a settlement with Endurance Warranty Services requiring the company to pay $550,000 in fines and implement sweeping changes to their marketing practices. The settlement came after state investigators received more than a dozen consumer complaints about deceptive direct mail campaigns targeting Oregon vehicle owners.

What Endurance Did: The Deceptive Mailer Campaign

According to the Oregon DOJ investigation, Endurance sent hundreds of thousands of mailers to Oregon residents between 2016 and 2019 that contained multiple false and misleading claims:

Key Allegations from Oregon Department of Justice:

- False urgency claims - Mailers pretended to know when specific vehicles' warranties expired or were about to expire

- "Final Notice" language - Made mailings appear to be official government or manufacturer communications

- Intimidating tone - Better Business Bureau characterized the mailers as containing "aggressive and confusing language that often intimidated consumers"

- Deceptive formatting - Designed to look like urgent notices rather than marketing materials

"It's my estimation it is mail fraud — or at least highly misleading advertising. They pretend to have specific knowledge about my vehicle's warranty status when they clearly don't." — Frank Dudgeon, Hillsboro, Oregon consumer complaint to Oregon DOJ (2019)

The Settlement Terms: What Endurance Must Do

The Oregon Assurance of Voluntary Compliance requires Endurance to:

- Pay $550,000 in civil penalties to the State of Oregon

- Cease all cold calling in Oregon for five years (through December 2027)

- Implement independent review process for all advertising directed toward Oregon residents

- Maintain documentation of compliance with settlement terms

- Report violations of the settlement to Oregon DOJ

The Better Business Bureau’s Prior Warning

The Oregon settlement wasn't Endurance's first warning about deceptive marketing. The Better Business Bureau of Chicago and Northern Illinois had been requesting since May 2019 that Endurance "modify or discontinue their promotional mailers being distributed nationwide" due to aggressive and confusing language.

The BBB posted an update in April 2020 indicating the mailers had been revised to meet BBB Code of Advertising standards—yet the Oregon investigation continued, resulting in the 2022 settlement.

Sources: Oregon Department of Justice, Better Business Bureau

The Active Class Action Lawsuit: Broken Promises on Claims

On March 19, 2025, law firm FeganScott filed a class action lawsuit against Endurance Warranty Services in the U.S. District Court for the Northern District of Illinois. The lawsuit, which remains active as of November 2025, alleges that Endurance systematically fails to deliver on its core contractual promises regarding claims processing.

What the Lawsuit Alleges

The class action complaint outlines a stark contrast between Endurance's marketing promises and customers' actual experiences:

| Endurance's Promise | Alleged Reality |

|---|---|

| "Stress-free claims process" | Customers report extensive delays, confusion, and frustration |

| "Claims approved in as little as 48 hours" | Claims reportedly take weeks or months to render decisions |

| "Direct payment to repair shops" | Shops report months of waiting, many refuse to work with Endurance |

| "Comprehensive coverage protection" | Denials based on narrow contract language interpretations |

| Customer Expectation: Peace of mind | Alleged Result: Thousands in out-of-pocket costs, vehicles unusable for extended periods |

"As a law firm dedicated to protecting consumers, we continue to find consumers abused in many different corners of the U.S. car industry. Whether it is a dangerous defect that can cause a vehicle to spontaneously erupt or a third-party warrantor failing to live up to its promises to protect consumers from unexpected and costly repairs, we are committed to ensuring that companies do not put their bottom lines ahead of consumers." — Jonathan Lindenfeld, FeganScott Attorney (FeganScott Press Release, March 2025)

Case Example: Kentucky Customer Experience

A July 2025 news investigation by WAVE 3 News in Louisville documented a case that mirrors the class action allegations:

Customer: Richard Leal (Elizabethtown, Kentucky)

- Vehicle: High-mileage SUV (259,000 miles)

- Problem: Transmission failure

- Experience:

- Transmission mechanic diagnosed failure, submitted claim

- Endurance denied claim - required inspection by their approved shop

- Two weeks passed with vehicle sitting

- Second shop inspection completed, claim approved for used transmission

- Endurance still wouldn't cover full bill even at reduced cost

- Result: $500 short after two months, customer cancelled coverage

"They do all they can to delay and deny coverage. I want to get all the money for this used transmission, money for my time I've wasted, this is multiple two months. They're making as much money as they can, when it comes time for you to put a claim in, find one way or another to deny you." — Richard Leal, Endurance customer (WAVE 3 News Investigation, July 2025)

Current Status & Implications

As of November 2025, the class action lawsuit is proceeding through discovery in federal court. The lawsuit seeks:

- Damages for breach of contract for all U.S. customers who purchased Endurance contracts

- Injunctive relief requiring Endurance to honor claims processing timelines

- Reimbursement for customers forced to pay out-of-pocket due to delays

- Policy changes to improve transparency and claims procedures

The existence of an active class action lawsuit—combined with the Oregon settlement—raises important questions about whether Endurance's "direct provider" model actually delivers better customer outcomes, or simply consolidates the same problems under one roof.

Sources: FeganScott Law Firm, WAVE 3 News Louisville, U.S. District Court Records

Better Business Bureau Rating: The Complaint Pattern Analysis

Endurance Warranty Services holds an A- rating from the Better Business Bureau and is a BBB Accredited Business. While this rating is better than many competitors, the volume and nature of complaints reveals consistent patterns that prospective customers should understand.

The Numbers: Complaints by Volume

Context matters: With 500,000+ customers, 3,300 complaints over three years represents less than 1% of their customer base. However, the consistency of complaint themes suggests systemic issues rather than isolated incidents.

Most Common Complaint Categories

| Complaint Type | Frequency | Core Issue |

|---|---|---|

| Pre-Existing Condition Denials | ~30% | Claims denied during 30-day waiting period despite no prior symptoms |

| Labor Rate Caps | ~25% | Customer forced to pay difference between shop rate and approved rate |

| Claims Processing Delays | ~20% | Weeks/months to approve despite "48-hour" promise |

| Coverage Misunderstandings | ~15% | Customers didn't understand stated component vs exclusionary differences |

| Cancellation/Refund Issues | ~10% | High admin fees ($300-400+), complex prorated calculations |

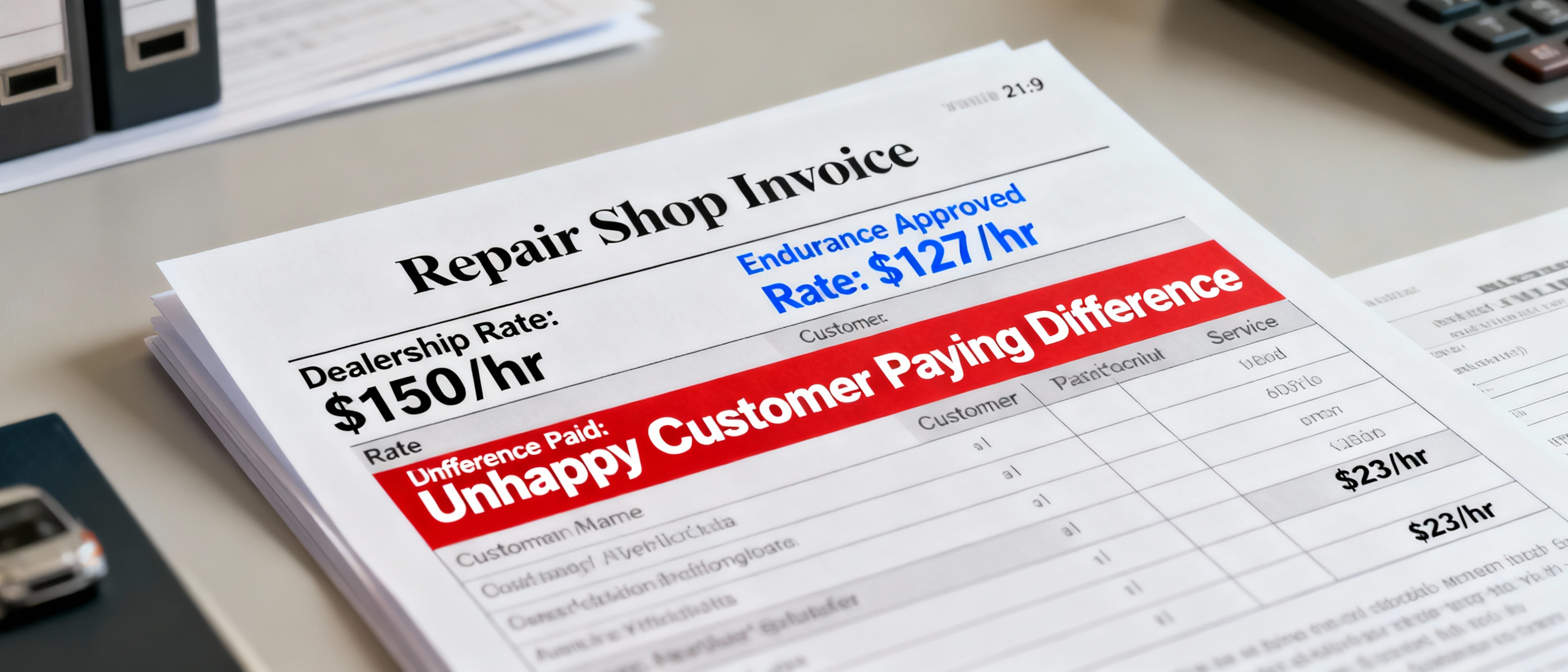

The Labor Rate Cap Problem: A Unique Endurance Issue

One complaint pattern stands out as particularly problematic for Endurance customers: labor rate reimbursement caps. Unlike coverage tier confusion (which affects all multi-tier providers), the labor rate issue appears unique to how Endurance structures their payments to repair facilities.

How Labor Rate Caps Work:

1. Customer takes vehicle to dealership for covered repair

2. Dealership charges market rate: $150/hour for labor

3. Endurance approves claim BUT caps labor reimbursement at $127/hour

4. Customer must pay $23/hour difference out of pocket

5. For a 10-hour transmission repair, customer pays extra $230 beyond deductible

Result: Many dealerships simply refuse to work with Endurance, limiting customer options and forcing them to find shops willing to accept below-market rates.

"Endurance's maximum labor reimbursement was $23/hour less than the dealership's rate, forcing me to pay the difference out of pocket. Additionally, I had other repairs performed that were clearly covered under my contract. However, because the dealer didn't include those repairs in the initial inquiry, Endurance flat-out refused to pay even though the contract showed the work was eligible." — BBB Complaint, Certified Dealership Customer, 2025

The Positive Side: What Satisfied Customers Report

To provide balanced context, it's important to note that the majority of Endurance reviews are positive:

- 68% give 5 stars on Trustpilot (12,000+ reviews)

- 4.6/5 stars on ConsumerAffairs (14,000+ reviews)

- 4.4/5 stars on Google (8,000+ reviews)

Common themes in positive reviews:

- Straightforward sales process without pressure

- Claims approved quickly when coverage was clearly applicable

- Direct payment to shops eliminated customer hassle

- Customer service responsive to questions

- Month-to-month flexibility appreciated

The divide between satisfied and dissatisfied customers often comes down to which coverage tier they purchased, whether their repair shop accepts Endurance, and whether they encountered labor rate cap issues or pre-existing condition determinations.

Sources: Better Business Bureau Endurance Profile, Trustpilot, ConsumerAffairs

Endurance Coverage Tiers Explained: The Six-Plan Complexity

Endurance offers six main coverage tiers, ranging from basic powertrain protection to near-comprehensive exclusionary coverage. Understanding the differences is critical—and where most customer frustration begins.

The Critical Question: Stated Component vs Exclusionary

Of Endurance's six plans, only ONE offers true exclusionary coverage (Supreme). The other five use stated component coverage, meaning they list specific parts covered—and if your part isn't on the list, it's not covered.

| Plan Name | Price Range | Coverage Type | Best For |

|---|---|---|---|

| Secure | $70-90/mo | Stated Component | Budget powertrain-only protection |

| Secure Plus | $90-110/mo | Stated Component | Older vehicles needing key systems covered |

| Select Premier | $100-120/mo | Stated Component | High-mileage vehicles (150K+ miles) |

| Superior | $110-130/mo | Stated Component | More comprehensive stated coverage |

| Supreme | $120-150/mo | EXCLUSIONARY | Customers wanting true comprehensive coverage |

| Advantage (3 sub-tiers) |

$140-200/mo | Varies by tier | Includes up to $3,500/year maintenance |

Detailed Coverage Breakdown by Plan

1. Secure Plan ($70-90/month)

Coverage Type: Stated Component (Powertrain Only)

- Engine internals (pistons, crankshaft, camshaft, etc.)

- Transmission internals

- Drive axle components

- Water pump

Best for: Absolute budget protection on newest vehicles with lowest risk

Waiting Period: 30 days/1,000 miles

2. Secure Plus Plan ($90-110/month)

Coverage Type: Stated Component

- Everything in Secure PLUS:

- Air conditioning system

- Brakes (master cylinder, boosters, calipers)

- Steering components

- Electrical (alternator, starter, voltage regulator)

- Seals and gaskets (when repaired with covered part)

Best for: Older vehicles where key systems are aging

Waiting Period: 30 days/1,000 miles (shortest waiting period of all plans)

3. Select Premier Plan ($100-120/month)

Coverage Type: Stated Component

- Similar coverage to Secure Plus

- Designed specifically for high-mileage vehicles

- Accepts vehicles over 150,000 miles

Best for: High-mileage drivers (150K-250K+ miles)

4. Superior Plan ($110-130/month)

Coverage Type: Stated Component

- Everything in Secure Plus PLUS:

- Suspension system

- Cooling system

- Fuel system

- More electrical components

The trap: Name suggests comprehensive coverage, but hundreds of parts still excluded

5. Supreme Plan ($120-150/month) ✅

Coverage Type: EXCLUSIONARY (True Comprehensive)

Coverage language: "ALL of Your Vehicle's part(s) or component(s), including seals and gaskets, except those listed under Exclusions."

Key Point: This is the ONLY Endurance plan offering exclusionary coverage similar to VIP's model

Standard Exclusions: Maintenance items, wear items, glass, tires, batteries, cosmetic damage

6. Endurance Advantage ($140-200/month)

Three Sub-Tiers:

- Advantage Prime: Mirrors Select Premier coverage + maintenance

- Advantage Plus: Mirrors Superior coverage + maintenance

- Advantage Preferred: Mirrors Supreme (exclusionary) + maintenance

Unique Feature: Includes up to $3,500 annual maintenance:

- Oil changes (up to 6 per year)

- Tire rotations

- Alignment checks

- Brake pad replacement (one time)

- Battery replacement (one time)

- Wiper blade replacement

Best for: Newer vehicle owners wanting combined breakdown + maintenance coverage

The Coverage Tier Trap That Generates Complaints

Common Customer Experience:

1. Customer shops based on price, sees "$110/month for Superior"

2. Thinks "Superior = comprehensive, I'm protected"

3. Doesn't realize Superior is stated component, not exclusionary

4. Year later, turbocharger fails ($2,800 repair)

5. Files claim, discovers turbos aren't covered under Superior

6. Endurance: "You needed Supreme for turbo coverage"

7. Customer: "But I paid for SUPERIOR coverage!"

8. Result: Angry customer, negative review, BBB complaint

This pattern—premium-sounding tier names masking stated component limitations—explains a significant portion of Endurance's negative reviews. It's not that Endurance refuses to pay covered claims; it's that customers fundamentally misunderstand what their specific tier actually covers.

Sources: Endurance Official Coverage Plans, Car Talk Endurance Review

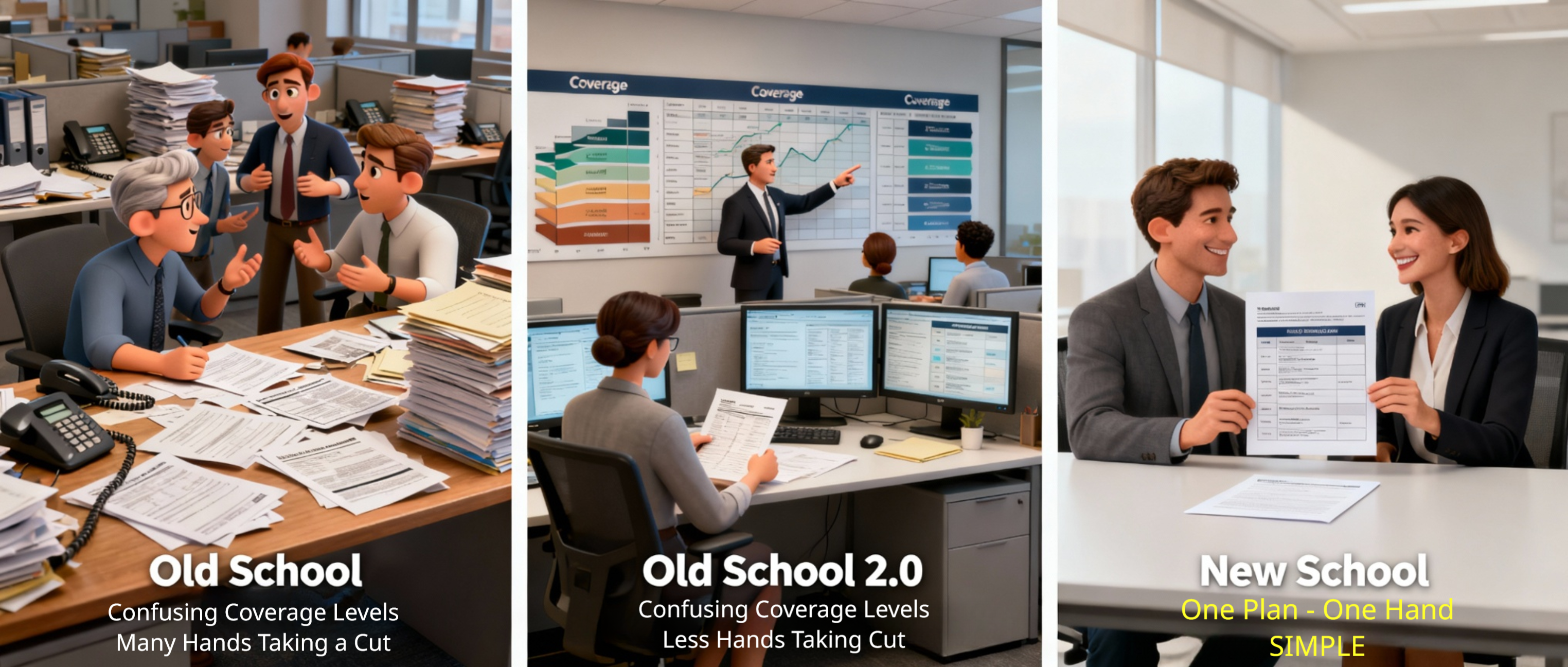

Direct Administration vs Broker Model: Does It Actually Matter?

Endurance's primary marketing differentiator is their direct provider model. But does eliminating the broker layer actually solve the problems extended warranty customers face? Let's examine what changes—and what doesn't.

What the Direct Model Actually Improves

✅ Real Advantages of Direct Administration

- Faster claim decisions - No waiting for third-party approval

- Single point of contact - One company handles everything

- Better accountability - Can't blame "administrator" for delays

- Potentially lower costs - Eliminates broker commission layer

- Clearer communication - Direct relationship with customer

❌ What Direct Administration Doesn't Fix

- Coverage tier complexity - Still 6 plans to navigate

- Stated component confusion - 5 of 6 plans still list parts

- Labor rate caps - Unique problem to Endurance

- Pre-existing condition denials - Still used during waiting periods

- Deductibles forever - $100-200 per visit never ends

Broker Model vs Direct Model: Side-by-Side Comparison

| Feature | Broker Model (CarShield) | Direct Model (Endurance) | Modern Model (VIP) |

|---|---|---|---|

| Layers Between Customer & Claims | 3 layers (Broker → Admin → Insurance) | 1 layer (Direct admin) | 1 layer (Direct admin) |

| Claims Processing Time | Variable (multiple approvals) | Promised 48 hours (disputed) | TBD (new company) |

| Coverage Tier Options | 4-6 tiers | 6 tiers | 1 type (exclusionary only) |

| Customer Question | "Which tier? Which parts?" | "Which tier? Which parts?" | "What's my dollar limit?" |

| Deductible Structure | $100-500 forever | $0-200 forever | $300 then $0 for life |

| Core Problem Solved? | ❌ No - Broker model complexity | ⚠️ Partially - Faster but still complex | ✅ Yes - Single simple coverage |

The “Evolution, Not Revolution” Reality

Endurance represents the extended warranty industry's attempt to modernize the traditional broker model by cutting out middlemen. This is a genuine improvement—claims theoretically process faster, accountability is clearer, and costs can be lower. But calling this "modern" misses the fundamental issue:

The Core Problem Isn't Who Administers Claims—It's What Customers Must Navigate:

- Six coverage tiers with confusing names (what does "Superior" actually mean?)

- Five of six plans using stated component (lists of parts customers must decode)

- Labor rate caps discovered only at claim time

- Deductibles that never disappear

- 30-day waiting periods used to deny claims as "pre-existing"

These problems exist whether there are three layers (broker model) or one layer (direct model). Endurance streamlined the process but didn't simplify the product.

Analogy: If buying a warranty is like navigating a complicated airport, Endurance didn't redesign the airport—they just removed some of the transfer shuttles. You still need to figure out which of six terminals (plans) to use, decode the departure board (coverage lists), and hope your destination (repair) is actually served.

Sources: Consumer Reports Extended Warranty Analysis, National Automobile Dealers Association

Endurance Pricing & Hidden Costs: What You’ll Actually Pay

Endurance doesn't publish standard rates, as pricing varies by vehicle make, model, age, mileage, and location. However, research across multiple sources reveals consistent pricing patterns—and several hidden costs customers discover only after purchasing.

Average Monthly Pricing by Tier

| Coverage Plan | Typical Monthly Cost | Annual Cost | 3-Year Total |

|---|---|---|---|

| Secure (Powertrain) | $70-90 | $840-1,080 | $2,520-3,240 |

| Secure Plus | $90-110 | $1,080-1,320 | $3,240-3,960 |

| Select Premier (High-mileage) | $100-120 | $1,200-1,440 | $3,600-4,320 |

| Superior | $110-130 | $1,320-1,560 | $3,960-4,680 |

| Supreme (Exclusionary) | $120-150 | $1,440-1,800 | $4,320-5,400 |

| Advantage (with maintenance) | $140-200 | $1,680-2,400 | $5,040-7,200 |

Sample Quotes from Independent Research:

- 2021 Ford Escape (50K miles): $126/month Supreme for 24-month term ($3,024 total)

- 2016 Toyota Camry (75K miles): $124-138/month across all tiers (surprisingly similar pricing)

- 2021 Nissan Altima (standard mileage): $87.81/month Supreme with $100 deductible

The Hidden Costs Customers Discover Later

1. Labor Rate Caps (Not Disclosed Upfront)

Endurance caps labor reimbursement below market rates. If your shop charges $150/hour but Endurance approves only $127/hour, you pay the $23/hour difference out of pocket—even though the repair is "covered." For a 10-hour transmission job, that's $230 extra beyond your deductible.

2. Deductibles Per Visit (Forever)

Unlike VIP's deductible that drops to $0 after 6 months, Endurance deductibles never go away:

- $0 deductible option: Highest monthly premium

- $50 deductible: Still higher premium

- $100 deductible: Standard (most common)

- $200 deductible: Lower premium, but $200 every single repair

If you file 5 claims over 3 years with a $100 deductible, that's $500 out-of-pocket in addition to monthly premiums.

3. Down Payment & Activation Fees

- First month's payment due upfront

- $29 activation fee for Elite Benefits (first year free, then annual)

- Total initial cost: $120-200 depending on tier selected

4. Cancellation Administration Fees

Multiple BBB complaints report cancellation admin fees of $300-400+ being deducted from prorated refunds. The exact fee structure varies by state and isn't always clearly disclosed during purchase.

5. Annual Price Increases

Some customers report annual increases of 10-15% on renewal. From BBB complaint:

"Despite not having filed a claim in 10 years, my premium kept escalating—$80, $90, $100, up to $145, which I found unreasonable."

Compare to VIP's 5% maximum annual increase policy.

True Total Cost of Ownership Example

Scenario: 2019 Toyota Camry, Supreme Plan, 3 Years

| Cost Component | Amount |

|---|---|

| Monthly premium (average $135) | $4,860 |

| Activation fee (year 1 free, years 2-3) | $58 |

| Deductibles (4 claims @ $100 each) | $400 |

| Labor rate difference (3 claims, avg $180) | $540 |

| TOTAL 3-YEAR COST | $5,858 |

This calculation assumes covered repairs saved more than $5,858 in total. If repairs cost less, the warranty was a net loss.

Sources: Automoblog Endurance Cost Analysis, ConsumerAffairs Endurance Reviews

Who Should Choose Endurance vs Modern Alternatives?

Endurance isn't right or wrong for everyone—it depends on your specific situation, preferences, and what you value most in vehicle protection.

Endurance Makes Sense If You:

- ✅ Want direct administration without broker layers

- ✅ Have a high-mileage vehicle (150K-250K+ miles) - Endurance accepts with unlimited mileage

- ✅ Value maintenance inclusion and choose Advantage plan for oil changes, tire rotations

- ✅ Are comfortable navigating six coverage tiers and reading dense contracts carefully

- ✅ Have a repair shop that accepts Endurance and works within their labor rate caps

- ✅ Want industry awards/recognition as credibility signals

- ✅ Prefer month-to-month flexibility over multi-year commitments

- ✅ Can afford deductibles every repair visit ($100-200 per claim)

Modern Subscription Model Makes More Sense If You:

- ✅ Value simplicity over options - One coverage type, pick your dollar limit

- ✅ Want true exclusionary coverage without navigating tier names

- ✅ Prefer deductibles that disappear ($0 after 6 months vs. $100+ forever)

- ✅ Expect Netflix-style transparency - All-in pricing, no labor rate caps

- ✅ Want maximum annual increase protection (5% cap vs. reported 10-15%)

- ✅ Are tired of industry-wide problems (waiting periods, pre-existing denials, stated component confusion)

- ✅ Need true cancel-anytime - Just stop paying, no admin fees

The Direct Question: Is “Better Than CarShield” Good Enough?

Endurance is objectively better than traditional brokers like CarShield in specific ways:

- Faster claims (no third-party approval delays)

- Better accountability (one company, can't blame "administrator")

- Higher industry ratings (A- BBB vs. CarShield's lower rating)

- More transparent operations (direct provider status)

But "better than CarShield" still means:

- Six coverage tiers to decode

- Five of six plans using stated component (part lists)

- Labor rate caps causing shop acceptance issues

- Deductibles that never end

- $550K Oregon settlement for deceptive marketing

- Active class action lawsuit for claims processing delays

The Bottom Line: If your question is "Should I choose Endurance over CarShield?" the answer is probably yes—direct administration is genuinely better. But if your question is "Should I choose Endurance over a truly modern subscription warranty?" that depends entirely on whether you value having six options to navigate vs. having one simple answer.

Sources: Consumer Reports, Car Talk

Tired of Navigating Six Coverage Tiers and Stated Component Lists?

VIP Warranty For Life offers single-plan exclusionary coverage. No tier confusion, no labor rate caps, no deductibles after 6 months. Just simple, transparent protection.

Get Your Instant QuoteOne coverage type • Pick your dollar limit • That's it

The Bottom Line: Evolution, Not Revolution

After examining Endurance's business model, regulatory history, legal challenges, customer complaints, and coverage structure, a clear picture emerges: Endurance represents the extended warranty industry's attempt to evolve the traditional broker model—but evolution isn't revolution.

What Endurance Gets Right

- ✅ Direct administration genuinely improves claims speed and accountability vs. brokers

- ✅ Maintenance coverage option (Advantage plans) is innovative and valuable

- ✅ Unlimited mileage acceptance helps high-mileage drivers others reject

- ✅ Supreme plan offers true exclusionary coverage for customers who find it

- ✅ Industry recognition and awards reflect legitimate business operations

- ✅ Nearly 20 years in business with 500,000+ customers served

What Endurance Hasn’t Solved

- ❌ $550K Oregon settlement reveals pattern of deceptive marketing

- ❌ Active class action lawsuit alleges systematic claims processing failures

- ❌ 3,300+ BBB complaints show consistent patterns (pre-existing denials, labor caps, delays)

- ❌ Six-tier complexity creates customer confusion despite direct administration

- ❌ Labor rate caps are unique problem causing shop acceptance issues

- ❌ Five of six plans use stated component coverage that customers misunderstand

- ❌ Deductibles never disappear unlike modern subscription models

The Industry Context: Where Does Endurance Fit?

| Model | Example | Core Problem | Customer Impact |

|---|---|---|---|

| Old School (Traditional Broker) |

CarShield | 3+ layers, broker commissions, slow claims, tier confusion | Delays, denials, expensive |

| Old School 2.0 (Direct Administrator) |

Endurance | Tier complexity remains, labor caps, stated component confusion | Faster but still confusing |

| New School (Modern Subscription) |

VIP Warranty | None - single exclusionary coverage, transparent pricing | Simple, clear, predictable |

So, Is Endurance Worth It in 2026?

Endurance is a legitimate company that has genuinely improved on the traditional broker model by becoming a direct administrator. For customers who:

- Have extremely high-mileage vehicles (200K+ miles)

- Value maintenance coverage inclusion

- Are comfortable navigating six coverage tiers

- Have repair shops that accept Endurance's labor rates

...Endurance can be a solid choice that's meaningfully better than traditional brokers like CarShield.

But for modern consumers who expect:

- Netflix-style simplicity (one thing, clearly explained)

- Transparent all-in pricing (no labor caps or hidden costs)

- Benefits that improve over time (deductibles dropping to $0)

- True cancel-anytime flexibility (no admin fees)

...Endurance's "Old School 2.0" model still asks too much navigation for too little simplicity. Direct administration is better, but it's not modern.

Final Recommendation: If you're choosing between Endurance and a traditional broker like CarShield, choose Endurance—the direct model is objectively better. But before committing to any traditional warranty structure (even improved ones), explore whether a truly modern subscription-based model better matches your expectations for how 2026 products should work.

Frequently Asked Questions: Endurance Warranty Review

Is Endurance Warranty Legit or a Scam?

Endurance is a legitimate company founded in 2006 with over 500,000 customers and nearly 20 years in business. However, the $550,000 Oregon Department of Justice settlement for deceptive marketing and the active class action lawsuit for claims processing delays indicate significant operational issues. Endurance is not a scam in the sense of taking money and disappearing, but customers should carefully review their coverage tier, understand labor rate caps, and read the complete contract before purchasing.

What Was the Endurance Oregon Settlement About?

In December 2022, Endurance paid $550,000 to settle Oregon Department of Justice allegations of deceptive direct mail marketing. The state found that Endurance sent hundreds of thousands of mailers between 2016-2019 that falsely claimed to know when vehicles' warranties expired, used intimidating "Final Notice" language, and were designed to appear like official communications rather than marketing. As part of the settlement, Endurance is banned from cold calling Oregon residents for five years and must implement independent review of all Oregon-directed advertising.

What Is the Endurance Class Action Lawsuit About?

Filed in March 2025 by FeganScott law firm, the class action alleges Endurance systematically fails to deliver on its promise of "stress-free 48-hour claims processing." Plaintiffs claim the company takes weeks or months to approve claims (if approved at all), leaves vehicles stuck in repair shops for extended periods, forces customers to pay thousands out-of-pocket, and denies coverage without justification. The lawsuit remains active in U.S. District Court for Northern District of Illinois as of November 2025.

What's the Difference Between Endurance Direct Administration and Broker Models Like CarShield?

Endurance is a direct administrator—they handle sales, contract management, claims processing, and payments to repair shops all in-house. Broker models like CarShield sell contracts but outsource claims administration to separate third-party companies. Direct administration theoretically means faster claims (no waiting for third-party approval), better accountability (one company responsible), and potentially lower costs (no broker commission). However, Endurance still uses six coverage tiers with five being stated component, maintains labor rate caps, and has accumulated 3,300+ BBB complaints, showing that direct administration doesn't automatically solve traditional warranty problems.

What Are Endurance Labor Rate Caps and Why Do They Matter?

Endurance caps labor reimbursement below market rates at many repair facilities. For example, if your dealership charges $150/hour but Endurance approves only $127/hour, you must pay the $23/hour difference out of pocket—even though the repair is "covered." For multi-hour repairs, this hidden cost can add hundreds of dollars beyond your deductible. Many dealerships refuse to work with Endurance due to these caps, limiting customer repair shop options. This problem is unique to Endurance's payment structure and doesn't affect all warranty providers.

Which Endurance Plan Offers True Exclusionary Coverage?

Only the Supreme plan offers exclusionary coverage—meaning everything is covered except a short exclusion list. The other five Endurance plans (Secure, Secure Plus, Select Premier, Superior, and Advantage Prime/Plus) all use stated component coverage, which lists specific parts covered. This distinction is critical: customers purchasing "Superior" often think they have comprehensive protection because of the premium-sounding name, only to discover hundreds of parts aren't covered when they file claims. If you want exclusionary coverage from Endurance, you must specifically purchase Supreme—but even then, you'll still face labor rate caps and permanent deductibles.

Ready for Warranty Coverage Built for 2026, Not 1996?

VIP Warranty For Life: One exclusionary plan. Transparent pricing. $0 deductible after 6 months. True month-to-month. No tier confusion. No labor rate caps.

See Your Quote NowVehicles up to 250,000 miles • Max 5% annual increases • Cancel anytime

About This Endurance Warranty Review

This comprehensive analysis was researched and written by the VIP Warranty For Life editorial team. We examined Oregon Department of Justice settlement documents, federal court class action filings, Better Business Bureau complaint data spanning three years, Trustpilot and ConsumerAffairs customer reviews, industry analysis from Consumer Reports and NADA, and direct comparison of Endurance contract terms. All claims are sourced to authoritative .gov and .org references listed below.

Our Perspective: As a modern subscription-based warranty provider, we have a business interest in explaining why "direct administration" alone doesn't solve traditional warranty complexity. However, we've made every effort to present Endurance fairly—acknowledging their genuine improvements over broker models, their industry awards, and the customers they serve successfully—while honestly discussing the Oregon settlement, active litigation, and systemic issues documented in thousands of customer complaints and legal proceedings.

Last Updated: November 22, 2025

Authoritative Sources & References

This Endurance warranty review cites the following authoritative sources:

- Oregon Department of Justice: Assurance of Voluntary Compliance Settlement (December 2022)

- FeganScott Law Firm: Endurance Class Action Lawsuit Filing (March 2025)

- Better Business Bureau: Endurance BBB Profile & Complaint Database

- U.S. District Court Northern Illinois: Federal Court Records & Filings

- Consumer Reports: Extended Car Warranty Buying Guide

- National Automobile Dealers Association (NADA): VSC Industry Data & Standards

- Federal Trade Commission: Consumer Protection Guidelines

- Trustpilot: 12,000+ Customer Reviews

- ConsumerAffairs: 14,000+ Customer Reviews

- Car Talk: Independent Endurance Analysis

- Automoblog: Comprehensive Cost & Coverage Review

- Inc. Magazine: Company Profile & Fast-Growing Recognition

- Endurance Official Website: Company Information & Coverage Plans

Additional context from state insurance regulators, automotive industry analysts, consumer protection organizations, and investigative journalism informed this analysis.