CarShield Review 2026: What the $10M FTC Settlement Reveals About Traditional Warranties

Last Updated: November 21, 2025 | 12 min read

In July 2024, CarShield review news made headlines when the company agreed to pay $10 million to settle Federal Trade Commission allegations of deceptive advertising. For the extended warranty industry's largest direct-to-consumer provider—a company that covers over 2 million vehicles—this wasn't just a fine. It was a snapshot of everything wrong with how traditional warranties operate in a modern marketplace.

This comprehensive CarShield review examines not just one company's missteps, but the fundamental disconnect between old-school warranty models built for 1990s consumers and today's digital-first buyers who expect transparency, simplicity, and flexibility. We'll explore the FTC settlement details, analyze customer complaint patterns, decode the confusing coverage tier system, and explain why the traditional multi-layer broker model creates the very problems consumers complain about.

Whether you're researching CarShield specifically or trying to understand extended warranties generally, this analysis will help you make an informed decision about protecting your vehicle.

What Is CarShield? Understanding the Industry Giant

Founded in 2005 and headquartered in St. Peters, Missouri, CarShield has grown into the extended warranty industry's most recognizable brand. With celebrity endorsers including Ice-T, Chris Berman, and Steve Harvey, the company has built a massive marketing presence that reaches millions of vehicle owners through television, radio, and digital advertising.

CarShield's Market Position:

- 2+ million vehicles currently covered across the United States

- $1+ billion in claims paid (according to company marketing, disputed by FTC)

- Coverage up to 300,000 miles available on eligible vehicles

- Month-to-month payment option alongside traditional term contracts

- Multiple coverage tiers from basic powertrain to near-comprehensive plans

Unlike dealership F&I office warranties, CarShield operates as a direct-to-consumer broker. They market and sell vehicle service contracts, but don't actually administer the claims—that's handled by a separate company called American Auto Shield. This multi-layer structure is standard in the traditional warranty industry, but as we'll explore, it creates inherent conflicts between marketing promises and claims reality.

Important Note: CarShield is not available in California due to that state's strict vehicle warranty regulations. This is common among direct warranty providers and worth noting if you're a California resident researching options.

Before the 2024 FTC settlement, CarShield positioned itself as offering "comprehensive coverage" and the ability to use "any repair shop." These claims became central to the regulatory action, as we'll detail in the FTC settlement section.

CarShield Coverage Plans Explained: The Tier Confusion Problem

CarShield offers multiple coverage tiers with premium-sounding names like "Diamond," "Platinum," "Gold," and "Silver." Here's where the first major customer confusion begins: these tiers don't differ just in coverage limits—they differ in what parts are actually covered.

Understanding CarShield’s Coverage Hierarchy

| Coverage Tier | Marketing Position | Actual Coverage Type | Key Limitations |

|---|---|---|---|

| Diamond | "Most Comprehensive" | Exclusionary coverage | Still excludes maintenance, wear items, high-tech systems |

| Platinum | "High Mileage Protection" | Stated component | Hundreds of parts NOT covered vs Diamond |

| Gold | "Popular Choice" | Stated component | Excludes AC, electronics, suspension, steering systems |

| Silver | "Affordable Option" | Powertrain Plus | Only engine, transmission, differential internals |

The Critical Difference: Exclusionary vs Stated Component

This is what most customers don't understand when signing up for CarShield:

❌ Stated Component Coverage

(Gold, Platinum, Silver)

- Contract lists specific parts covered

- If your part isn't on the list → Not covered

- Thousands of parts exist on modern vehicles

- Easy to think you're covered when you're not

- Example: "Platinum" sounds comprehensive but may exclude turbos, hybrid systems, advanced electronics

✅ Exclusionary Coverage

(Diamond Only)

- Contract lists what's NOT covered

- Everything else is covered (except exclusions)

- Much shorter list to track

- Clearer coverage boundaries

- But: Even Diamond has extensive exclusion lists for wear items, maintenance, modifications

The Coverage Gap That Creates Complaints: A customer purchasing "Platinum" coverage for $169/month may think they have comprehensive protection because the name sounds premium. When their turbocharger fails ($3,200 repair), they discover turbos aren't covered under Platinum—only Diamond. This perception gap generates most of the "they denied my claim!" complaints across the industry.

According to Consumer Reports, this stated component limitation is "the most common reason vehicle owners feel deceived by their extended warranty." The issue isn't that companies refuse to pay—it's that customers fundamentally misunderstand what their specific tier actually covers.

Sources: Consumer Reports Extended Warranty Guide, National Automobile Dealers Association (NADA)

The $10 Million FTC Settlement: What Actually Happened

On July 31, 2024, the Federal Trade Commission announced a $10 million settlement with CarShield to resolve allegations of deceptive advertising and marketing practices. This wasn't CarShield's first regulatory issue—Missouri's Attorney General had reached a previous settlement in 2020—but the FTC action brought national attention to problems the agency described as industry-wide.

Specific FTC Allegations Against CarShield

The FTC complaint detailed several deceptive marketing claims:

- "Comprehensive Coverage" Misrepresentation: CarShield advertised plans as providing comprehensive or extensive coverage while the actual contracts contained what the FTC called "myriad exclusions" that weren't disclosed during the marketing pitch.

- Repair Shop Choice Limitations: Marketing suggested customers could use "any repair shop" or "the shop of your choice," but many shops refuse to work with CarShield due to used parts requirements and payment delays.

- Celebrity Endorser Deception: Ice-T and other celebrity spokespersons presented themselves as CarShield customers, but the FTC found they were simply paid endorsers who didn't actually use the service.

- Rental Car Misleading Claims: Advertising promised "no-cost" rental car coverage, but the benefit had numerous conditions and limitations not disclosed upfront.

- Dense Contract Disclosure Failures: The actual service contracts ran 25-30 pages with extensive exclusions, but these weren't adequately disclosed to customers during the sales process.

"CarShield's deceptive advertising left consumers holding the bag when their car repair bills weren't paid as promised. Today's action should serve as a reminder to other advertisers that the FTC will hold them accountable for their deceptive claims." — Samuel Levine, Director of the FTC's Bureau of Consumer Protection (FTC Press Release, July 31, 2024)

CarShield’s Response and Changes

While not admitting wrongdoing (standard in regulatory settlements), CarShield agreed to:

- Pay $10 million in consumer redress

- Add over 10,000 repair facilities to their approved network

- Revise marketing materials to include clearer limitation disclosures

- Implement stricter advertising review protocols

- Update telemarketer scripts to prevent misrepresentation

Important Context: The FTC explicitly noted that the problems identified in CarShield's marketing are "common throughout the vehicle service contract industry." This wasn't about one bad actor—it was about an outdated business model struggling to meet modern transparency standards.

Sources: FTC Press Release (July 2024), U.S. Department of Justice

The Real Customer Experience: What CarShield Reviews Reveal

Any CarShield review analysis must look at actual customer experiences beyond the company's marketing claims. The data reveals a stark divide between platforms and a clear pattern of specific complaint types.

The Rating Split: BBB vs Consumer Review Sites

Why such different ratings? The BBB primarily receives complaints from unhappy customers with unresolved issues, while Trustpilot captures more diverse experiences including satisfied customers. Both data sets are valid but represent different self-selected populations.

Most Common CarShield Complaints by Category

| Complaint Type | Frequency | Core Issue |

|---|---|---|

| Coverage Denials | 35% of complaints | "Part not covered under my tier" or "Pre-existing condition" |

| Repair Shop Issues | 25% of complaints | Shops won't accept CarShield due to used parts requirements |

| Claims Processing Delays | 20% of complaints | Extended approval times leaving vehicles in shop for weeks |

| Cancellation Difficulties | 12% of complaints | Complex cancellation process, refund disputes |

| Pricing Surprises | 8% of complaints | Undisclosed surcharges, deductible confusion, price increases |

Source: Better Business Bureau CarShield Profile (2022-2025)

Understanding the “Pre-Existing Condition” Pattern

One of the most frustrating complaint patterns involves claim denials for "pre-existing conditions." Unlike health insurance where this term is well-understood, vehicle warranty "pre-existing condition" clauses can be applied broadly. If a mechanic notes any evidence of prior wear or damage to a related system, the warranty company may argue the failure was pre-existing—even if the customer had no knowledge of any problem.

This issue affects the entire traditional warranty industry, not just CarShield. According to Consumer Reports, "pre-existing condition exclusions are the second most common reason for claim denials across all extended warranty providers."

The Positive Experiences

To be fair, thousands of CarShield customers report positive experiences. Common themes among satisfied customers include:

- Major repairs fully covered (when part was clearly covered under their tier)

- Month-to-month flexibility appreciated (no multi-year commitment pressure)

- Responsive customer service when calling with questions

- Straightforward claims process when coverage was clearly applicable

The divide between satisfied and dissatisfied customers often comes down to coverage tier understanding. Customers who carefully reviewed their contract and understood their specific tier's limitations generally report better experiences than those who relied on marketing impressions.

Sources: Better Business Bureau, Trustpilot, Consumer Reports

The Traditional Warranty Business Model: Why This Creates Problems

To understand why CarShield and similar companies generate so many complaints, you need to understand the fundamental economics of the traditional warranty broker model. This isn't about one company being unethical—it's about a business structure that creates inherent conflicts between customer expectations and company incentives.

The Multi-Layer Distribution Chain

When you purchase a traditional extended warranty, here's where your money typically goes:

| Layer | Typical Percentage | Function |

|---|---|---|

| Dealer Markup (if purchased through dealer) |

30-50% | Dealer's profit for selling the contract |

| Broker Commission (CarShield's cut) |

20-25% | Marketing costs, sales commissions, company profit |

| Administrator Fees (American Auto Shield) |

15-20% | Claims processing, network management, overhead |

| Marketing & Overhead | 15-20% | Celebrity endorsements, TV ads, support infrastructure |

| Insurance Backing | 5-10% | Reinsurance costs, regulatory reserves |

| Actual Claims Reserves | 5-10% | Money available to pay your actual claims |

Note: Percentages vary by company and purchase channel. NADA data shows dealership VSC gross profits average $1,500-$2,000 per contract.

Why This Model Creates Claim Pressure

When only 5-10% of customer premiums reach actual claims reserves, every dollar paid out on claims directly impacts profitability. This creates systemic pressure to:

- Narrow coverage interpretations — Finding reasons why specific repairs don't qualify

- Rigorous pre-existing condition scrutiny — Any evidence of prior wear becomes grounds for denial

- Used parts requirements — Reducing claim costs (while frustrating repair shops)

- Extended claims review periods — Slowing approvals hoping customers pay out-of-pocket

- Complex contract language — Making coverage boundaries difficult for customers to understand

The Fundamental Conflict: In traditional warranty models, the company's profit interest directly conflicts with the customer's claim interest. Every claim paid reduces profitability. While this is true of all insurance, the extreme multi-layer markup in the warranty industry makes this conflict particularly acute. According to NADA, traditional VSC loss ratios (claims paid vs premiums collected) average only 40-55%—meaning companies retain 45-60% of premiums as profit and overhead.

Why This Model Persists

The traditional multi-layer structure exists because it was built for dealership F&I offices where:

- Customers purchased in-person after buying a vehicle

- Finance managers explained the contract (theoretically)

- Commission incentives drove the sales force

- Complex products were standard across insurance industries

But modern consumers research online, expect Netflix-style transparency, and want direct relationships without middlemen. The old model hasn't adapted to these changed expectations—it's simply tried to move the same structure to direct-to-consumer marketing, creating the disconnect the FTC identified.

Sources: National Automobile Dealers Association (NADA) 2023 Data, Federal Trade Commission Consumer Guides

CarShield Pricing & Hidden Costs: The Bait-and-Switch Reality

CarShield's marketing typically advertises plans "starting at $99/month" or similar low entry prices. But actual costs often differ significantly due to multiple surcharges that aren't disclosed until after you've provided your vehicle information.

Advertised vs Actual CarShield Costs

| Cost Component | Advertised Message | Actual Reality |

|---|---|---|

| Base Monthly Price | "Starting at $99/month" | $99-$249/month depending on vehicle, mileage, tier |

| Down Payment | Not prominently mentioned | $200-$300 typical first payment |

| Deductible | "Low deductibles" | $100-$500 per repair visit (every time) |

| Branded Title Surcharge | Not disclosed in ads | +$20-40/month if salvage/rebuilt title |

| Commercial/Rideshare Use | Not disclosed in ads | +$30-50/month or complete exclusion |

| High-Risk Vehicle Surcharge | Not disclosed in ads | +$15-35/month for certain makes/models |

| Turbo/Supercharged Surcharge | Not disclosed in ads | +$10-25/month for forced induction |

| 4x4/AWD Surcharge | Not disclosed in ads | +$10-20/month for 4WD/AWD systems |

| ACTUAL TOTAL | $99/month advertised | $150-$300/month common |

The Quote vs Reality Gap

Here's a common scenario reported in consumer complaints:

Example Customer Experience:

Customer sees "$99/month" advertising → Calls for quote on 2019 F-150 with 85,000 miles → Quoted $129/month for Gold coverage → Signs up → First bill is $159/month + $250 down payment → Discovers the quote didn't include 4x4 surcharge, turbo surcharge, and higher deductible tier → Total annual cost is $2,158 vs. advertised $1,188.

This pattern—advertised low price, surcharges added later—is what creates the "bait-and-switch" perception that contributed to the FTC enforcement action. While the surcharges may be disclosed somewhere in the fine print or during the phone call, they're not prominent in the marketing that drives customers to call.

Understanding Total Cost of Ownership

When evaluating any extended warranty, calculate your true total cost including:

- Monthly premium × contract length

- Down payment or first payment fees

- All surcharges for your specific vehicle

- Deductible × expected number of repairs

- Any annual administrative or renewal fees

For CarShield customers, total cost over 3 years can range from $5,000-$11,000 depending on vehicle type, mileage, coverage tier, and how many claims are filed (remember those per-visit deductibles).

Sources: Analysis of BBB complaints, Consumer Reports extended warranty cost studies

The New Way: Modern Subscription-Based Vehicle Warranties

While CarShield and traditional providers continue operating with multi-tier, multi-layer models built for 1990s consumers, a new category of warranty provider has emerged targeting modern buyers who expect the same transparency and flexibility they get from Netflix, Amazon Prime, and other subscription services.

Old School vs New School: Fundamental Differences

| Feature | Traditional Model (CarShield) | Modern Subscription Model |

|---|---|---|

| Coverage Structure | 5-6 tiers with different parts covered | One coverage type: Exclusionary only |

| Customer Question | "Which tier do I need?" "Is this part covered?" |

"What's my dollar limit?" "Is this maintenance?" (only exclusion) |

| Contract Complexity | 25-30 pages, thousands of parts listed | Short exclusion list (maintenance, wear items) |

| Business Structure | Broker → Administrator → Insurance (3+ layers taking cuts) |

Direct administration (no middlemen) |

| Commitment | 1-7 year terms OR month-to-month (but same model either way) |

True month-to-month (cancel anytime, no penalties) |

| Deductible | $100-$500 per repair visit forever | Typical: $300 first 6 months, then $0 for life |

| Pricing | Base price + multiple surcharges | All-in transparent pricing, no surcharges |

| Price Increases | Variable, often 10-15% annually | Capped (typically 5% max annually) |

| Mileage Limits | Usually won't accept over 150k miles | Often accept up to 250k miles |

| Sales Channel | Built for dealer F&I office sales | Built for online research and purchase |

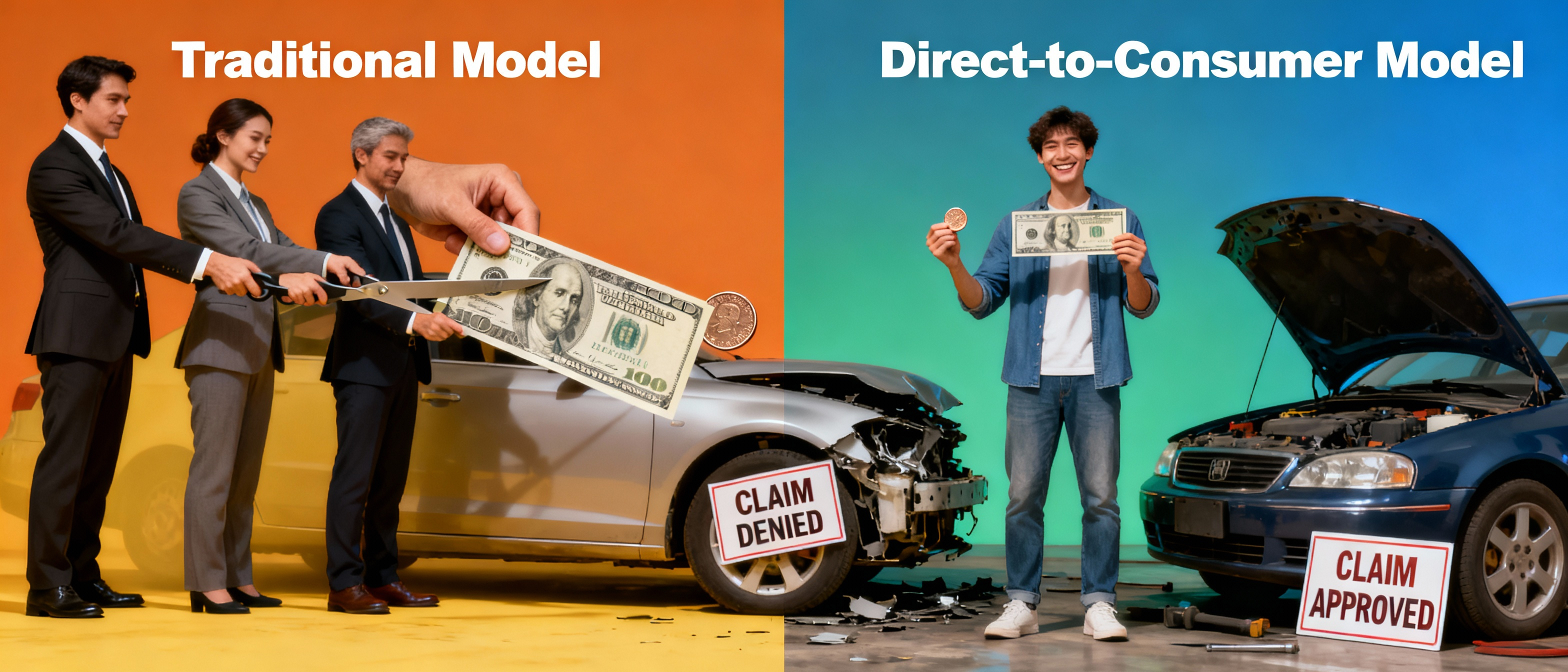

The Philosophy Shift: Customer-First Economics

Modern subscription warranty providers eliminate the multi-layer broker structure entirely, working directly with insurance backing. This means:

- 40-50% more money reaches claims reserves — By cutting out dealer markups, broker commissions, and administrator fees

- Lower prices or better coverage (or both) — Less overhead means better value

- Reduced claim denial incentive — With more money in reserves, paying legitimate claims doesn't threaten profitability

- Simplified operations — Direct administration means faster claims, clearer communication

Example: VIP Warranty For Life Approach

As a new-school provider, VIP eliminates tier confusion entirely by offering only exclusionary coverage. Customers simply choose their annual dollar limit ($2,500, $5,000, $7,500, or higher) knowing that everything except routine maintenance is covered. The deductible drops to $0 after just 6 months. They accept vehicles up to 250,000 miles. And true month-to-month means cancel anytime with no penalties—just stop paying.

This isn't revolutionary—it's just applying modern subscription business principles to an industry that hasn't updated its model since the 1990s.

Not Just About Price—It’s About Clarity

The shift to subscription-based warranties isn't primarily about being cheaper (though eliminating middlemen helps). It's about matching how modern consumers want to buy:

🕰️ What Modern Consumers Expect

- Research online before buying

- Transparent all-in pricing

- Simple yes/no coverage answers

- Cancel anytime flexibility

- Mobile-first service

- Direct relationships without layers

📋 What Traditional Warranties Deliver

- Complex in-person sales pitch

- Base price + surprise surcharges

- "Is this covered?" uncertainty

- Multi-year commitments or complex cancellation

- Call-center focused

- Multiple companies in the chain

This gap explains why warranty companies dominate "worst extended warranty" forum discussions despite paying billions in legitimate claims annually. The model isn't meeting modern expectations.

Note: VIP Warranty For Life represents one example of the new-school approach. Other emerging providers are adopting similar subscription-based, single-coverage-type models.

Who Should Choose CarShield vs Modern Alternatives?

This isn't about declaring one approach universally superior—it's about matching the warranty model to your specific situation and preferences.

CarShield (Traditional Model) Might Work Well If You:

- ✅ Want the absolute lowest possible monthly payment and accept higher deductibles and coverage gaps as the tradeoff

- ✅ Are comfortable with complexity and willing to carefully read 25-30 page contracts to understand coverage boundaries

- ✅ Have a vehicle under 150,000 miles that fits within their traditional acceptance criteria

- ✅ Don't drive commercially or for rideshare (which triggers significant surcharges or exclusions)

- ✅ Have a specific repair shop that accepts CarShield and you've confirmed they're willing to work with them

- ✅ Prefer phone-based customer service and don't mind calling for every question or claim

- ✅ Can afford per-visit deductibles of $100-$500 every time you need a repair

Modern Subscription Model Makes More Sense If You:

- ✅ Value simplicity and transparency over hunting for the cheapest base price

- ✅ Want predictable all-in costs without surprise surcharges or escalating deductibles

- ✅ Drive higher mileage (150,000-250,000 miles) that traditional providers reject

- ✅ Expect modern consumer flexibility like Netflix-style cancel-anytime terms

- ✅ Prefer online research before buying and want to understand your coverage without a sales call

- ✅ Are tired of "part not covered" surprises and want exclusionary coverage that protects everything except a short list

- ✅ Want a $0 deductible eventually instead of paying $100-$500 per visit indefinitely

- ✅ Appreciate direct relationships without wondering which middleman is causing delays

The Core Question: Do you want a warranty built for 1995 car buyers (dealer F&I office, complex tiers, commission-driven) or one built for 2025 digital consumers (online research, simple coverage, subscription flexibility)?

Both models work—but they serve fundamentally different customer preferences.

Questions to Ask Any Warranty Provider

Regardless of which model you choose, ask these questions before purchasing:

- "Is this stated component or exclusionary coverage?" — Understand what's actually protected

- "What's the total all-in price including every surcharge for MY specific vehicle?" — Get past advertised rates

- "How much is the deductible per repair, and does it ever decrease?" — Calculate true cost per claim

- "What's the cancellation policy and refund calculation?" — Understand your exit options

- "Can I see the actual contract before purchasing?" — Review exclusions yourself

- "What percentage of my payment goes to actual claims reserves?" — Understand the economics

- "How do you handle pre-existing condition determinations?" — Know the biggest denial reason

- "Will repair shops in my area actually accept you?" — Call shops to confirm

If a warranty provider won't answer these questions clearly or tries to rush you through the process, that's a red flag regardless of whether they're old-school or new-school.

Tired of Complex Coverage Tiers and Hidden Surcharges?

VIP Warranty For Life offers single-plan exclusionary coverage with transparent pricing, $0 deductible after 6 months, and true month-to-month flexibility. See what simple, modern warranty coverage looks like.

Get Your Instant QuoteNo salespeople, no pressure. Just honest pricing in 60 seconds.

The Bottom Line: Is CarShield Worth It in 2026?

After examining the $10 million FTC settlement, analyzing thousands of customer complaints, reviewing the multi-layer business model economics, and comparing traditional vs modern warranty approaches, here's the fair summary:

CarShield Is Not a Scam—But It’s Old School

CarShield is a legitimate company that has paid billions in claims and covered millions of vehicles over 20 years. They're not a scam in the sense of taking money and disappearing. But they operate using a business model designed for 1990s consumers that increasingly fails to meet modern buyer expectations for transparency, simplicity, and flexibility.

The FTC Settlement Reveals Systemic Industry Problems

The $10 million penalty wasn't about CarShield being uniquely bad—it was about the FTC using the industry's largest direct marketer to send a message about widespread practices. As the FTC explicitly noted, the problems identified in CarShield's marketing are "common throughout the vehicle service contract industry."

The traditional multi-tier, multi-layer broker model creates:

- Inherent complexity that confuses customers

- Economic pressure to narrow coverage interpretations

- Misalignment between marketing promises and contract reality

- Multiple middlemen all taking fees before money reaches claims

The Warranty Industry Is Splitting

We're watching an industry divergence in real time:

🕰️ Doubling Down on Old School

CarShield, Endurance, and traditional providers continue refining the multi-tier broker model—adding more tiers, more celebrity endorsers, more aggressive marketing. They're betting customers will continue accepting complexity in exchange for low advertised prices.

🚀 Embracing New School

VIP Warranty and emerging subscription-based providers are eliminating tiers entirely, cutting out middlemen, offering exclusionary-only coverage, and building for digital-first consumers who expect Netflix-style transparency and flexibility.

Which Model Will Win?

Both models will likely coexist for years—serving different customer segments with different preferences. Some buyers will always prefer hunting for the lowest advertised price even if it comes with complexity. Others will pay moderately more for simplicity, transparency, and modern flexibility.

The question for YOU is: Which type of buyer are you?

Final Recommendation: Whether you choose CarShield, VIP Warranty, or any other provider, make your decision based on:

- Understanding the ACTUAL coverage you're getting (not marketing claims)

- Calculating the TRUE total cost (including all surcharges and deductibles)

- Matching the business model to your personal preferences for complexity vs simplicity

- Confirming repair shops in your area will actually accept the warranty

An informed customer makes better decisions regardless of which provider they ultimately choose.

Frequently Asked Questions: CarShield Review

Is CarShield a Scam or Legitimate Company?

CarShield is a legitimate company founded in 2005 that has covered over 2 million vehicles and paid billions in claims. However, the $10M FTC settlement and BBB F rating indicate significant customer service issues. The company is not a scam, but operates using a traditional multi-tier warranty model that creates confusion and generates complaints. Whether CarShield is right for you depends on your comfort with complexity and willingness to carefully review contract terms.

Why Did CarShield Pay $10 Million to the FTC?

In July 2024, CarShield settled FTC allegations of deceptive advertising including: misrepresenting coverage as "comprehensive" when contracts contained extensive exclusions, falsely claiming customers could use "any repair shop," using celebrity endorsers who weren't actual customers, and failing to adequately disclose contract limitations. While not admitting wrongdoing, CarShield paid $10M and agreed to revise marketing practices. The FTC noted these problems are "common throughout the vehicle service contract industry."

What's the Difference Between CarShield and Modern Subscription Warranties Like VIP?

CarShield uses the traditional model with 5-6 coverage tiers (Diamond, Platinum, Gold, Silver), multi-layer broker structure (CarShield → Administrator → Insurance), stated component coverage on most tiers, and per-visit deductibles forever. Modern subscription providers like VIP offer single exclusionary coverage (one type, just pick your dollar limit), direct administration (no middlemen), $0 deductible after 6 months, and true month-to-month cancellation. Traditional model = lower advertised prices with complexity; subscription model = higher transparency with simplicity.

Will CarShield Actually Pay My Claims?

CarShield does pay billions in legitimate claims annually. However, claim denials are common when: (1) the repair involves parts not covered under your specific tier, (2) the administrator determines pre-existing condition, (3) the repair shop won't accept used parts or CarShield's payment terms, or (4) the claim falls outside contract terms. The high complaint rate isn't primarily about refusing to pay covered claims—it's about customers not understanding what their specific tier actually covers, creating a "part not covered" surprise when claims are filed.

Can I Trust Online CarShield Reviews?

Online reviews show a stark split: BBB rates CarShield F with 1.79/5 stars from 600+ reviews and 3,300+ complaints, while Trustpilot shows 4.3/5 stars from 23,000+ reviews. This divide reflects different self-selected populations—BBB primarily captures unhappy customers with unresolved issues, while Trustpilot includes more satisfied customers. Both data sets are real experiences, but represent different customer segments. Read multiple sources and look for specific patterns (coverage tier confusion, repair shop acceptance issues, claims delays) rather than just overall ratings.

How Do I Avoid Extended Warranty Scams?

Legitimate warning signs include: pressure to "buy today or lose this price," refusal to send contract for review before purchase, inability to verify insurance backing, no physical company address, prices significantly below market rates, and unwillingness to answer direct questions about coverage type, claims procedures, and cancellation policies. Verify companies through BBB, state insurance departments, and by calling repair shops in your area to confirm they accept that warranty. Always review the actual contract (not marketing materials) before purchasing, and understand whether you're getting stated component or exclusionary coverage.

Ready for Simple, Transparent Vehicle Protection?

Skip the coverage tier confusion. VIP Warranty For Life offers one exclusionary plan, transparent all-in pricing, and modern subscription flexibility. See your personalized quote in 60 seconds.

Get Instant Quote NowCovers vehicles up to 250,000 miles • $0 deductible after 6 months • Cancel anytime

About This CarShield Review

This comprehensive analysis was researched and written by the VIP Warranty For Life editorial team. We examined public FTC documents, Better Business Bureau complaint data, consumer review platforms, industry structure analysis from NADA, and Consumer Reports warranty guidance. All claims are sourced to authoritative .gov and .org references listed below.

Our Perspective: As a modern subscription-based warranty provider, we have a business interest in explaining why the traditional multi-tier model creates customer frustration. However, we've made every effort to present CarShield and traditional warranties fairly—acknowledging their legitimacy, market position, and the customers they serve successfully—while honestly discussing systemic structural issues backed by regulatory findings.

Last Updated: November 21, 2025

Authoritative Sources & References

This CarShield review cites the following authoritative sources:

- Federal Trade Commission (FTC): CarShield $10M Settlement Press Release (July 2024)

- Better Business Bureau: CarShield BBB Profile & Complaint Database

- Consumer Reports: Extended Car Warranty Buying Guide

- National Automobile Dealers Association (NADA): VSC Industry Data & Statistics

- U.S. Department of Justice: Consumer Protection Division Resources

- Trustpilot: Independent Consumer Review Platform

- CarShield Official Website: Company Information & Coverage Details

Additional context from state insurance regulators, automotive industry analysts, and consumer protection organizations informed this analysis.