CARCHEX Review 2026: The Hidden Cost of 20 Plans and 8 Administrators

When you purchase a CARCHEX review extended warranty, you're not actually buying from CARCHEX. You're buying from one of eight different administrators through one of 20 different plans—and you won't know which one until after you commit. This broker model isn't unique to CARCHEX, but they've perfected the complexity in ways that deserve scrutiny. After 25 years in business and an A+ BBB rating, CARCHEX has become one of the most recognized names in extended vehicle protection. But beneath that polished reputation lies a maze of administrators, exclusions, and pricing that can leave even savvy consumers confused about what they're actually buying.

This CARCHEX warranty review examines the documented facts about how the broker model works, what it costs consumers in both money and clarity, and when—if ever—this approach makes sense for protecting your vehicle.

What Is CARCHEX? The Broker Model Explained

CARCHEX (officially Carchex, LLC) was founded in 1999 and operates from Hunt Valley, Maryland. With 25 years in the industry, approximately 80 employees, and annual revenue around $35 million, CARCHEX has established itself as a significant player in the extended warranty market. The company has earned an A+ rating from the Better Business Bureau and maintains accreditation since 2009.

But here's what makes CARCHEX fundamentally different from companies like VIP Warranty For Life: CARCHEX doesn't actually provide warranties.

This means every claim, every repair authorization, and every coverage decision is handled by a third-party administrator—not CARCHEX. Your experience depends entirely on which administrator's plan CARCHEX selects for your vehicle.

The Eight Administrators Behind CARCHEX

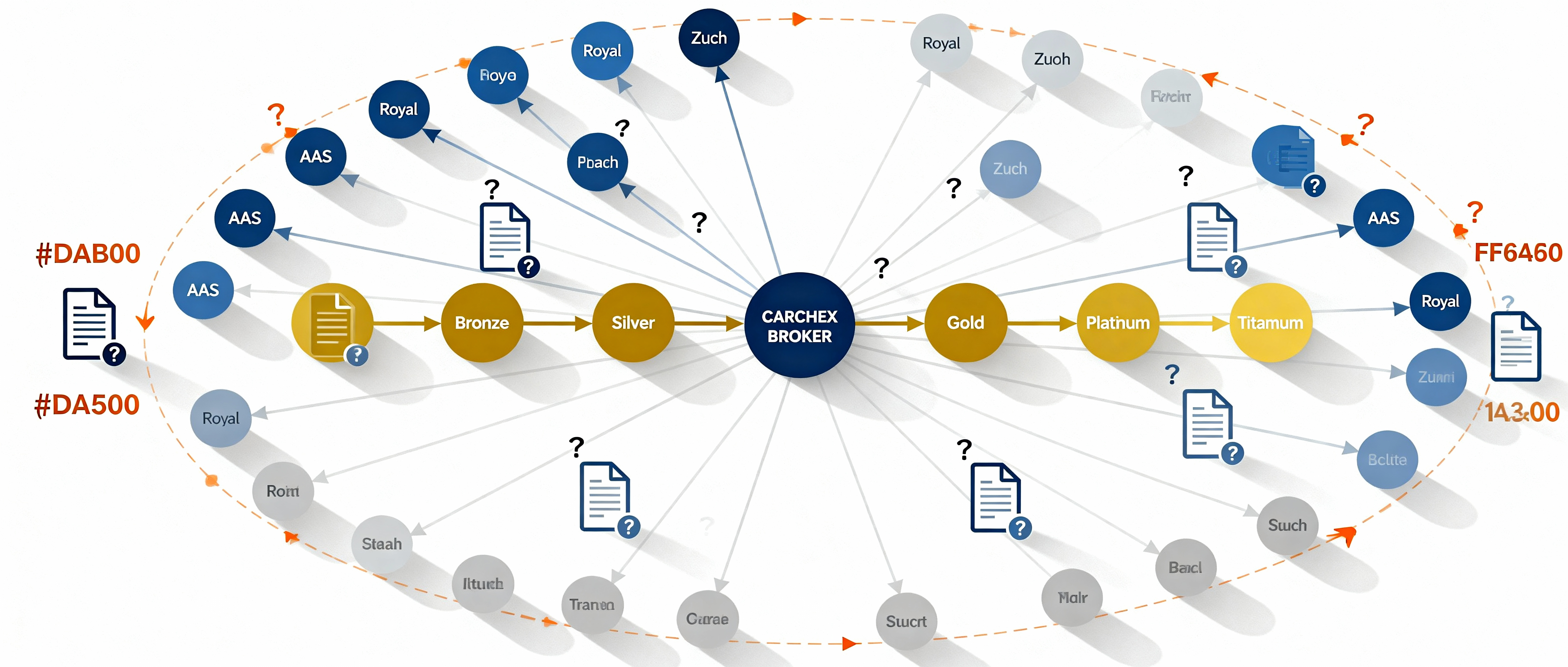

CARCHEX currently brokers plans from eight different administrators:

- American Auto Shield (AAS) - The primary administrator

- Royal Administration Services - Offers longer-term contracts

- Zurich - Insurance-backed coverage

- Assurant Solutions - Multi-line administrator

- Allegiance - Warranty specialist

- National Administration Services Co. - Regional coverage

- Enterprise Financial Group - Financial services backed

- The Warranty Group - International administrator

Each administrator has different claims processes, different labor rate schedules, different approved repair facilities, and different interpretations of contract language. This is the first hidden cost of the broker model—inconsistency.

The 20-Plan, 8-Administrator Maze

CARCHEX offers five coverage tiers: Bronze (powertrain only), Silver (powertrain plus), Gold (major systems), Platinum (comprehensive stated component), and Titanium (exclusionary). Simple enough, right? Not quite.

Within these five tiers exist approximately 20 different actual plans, each administered by different companies with different contract terms. For example, a "Platinum" plan might be:

- American Auto Shield Platinum (5-year max)

- CARCHEX Care by Royal Platinum (7-year max)

- Royal Administration Services Platinum (10-year max)

- Zurich Platinum (different exclusions)

Same tier name, different coverage limits, different contract language, different claims departments. The Car Talk review of CARCHEX confirms this complexity: "The list of 20 different policy options plus additional riders to the policy would make such a chart meaningless. You have to call CARCHEX and speak to an agent to find out what the company has for offerings for your vehicle."

The Ownership Connection You Should Know About

Here's a fact that doesn't appear in CARCHEX's marketing materials but is documented in BBB records: "Ted Terry, of Russell Place Partners, LLC, owner of Carchex, LLC, also owns American Auto Shield, LLC."

This matters because American Auto Shield (AAS) was the primary administrator in the $10 million FTC settlement with CarShield in July 2024. The FTC alleged that AAS, as the claims administrator, participated in deceptive practices including:

- Denying coverage for repairs consumers believed were covered

- Refusing to work with certain repair facilities

- Using narrow contract interpretations to avoid claims

- Failing to provide promised rental cars

CARCHEX's primary administrator—owned by the same person who owns CARCHEX—was a co-defendant in one of the largest warranty industry settlements in FTC history. While CARCHEX itself was not named in the settlement, the connection raises important questions about claims administration practices.

Coverage Tiers Decoded: What You’re Actually Buying

Understanding CARCHEX's five coverage tiers is complicated by the fact that each tier is offered by multiple administrators with different terms. Here's what each tier generally covers:

| Coverage Tier | What's Covered | Best For | Maximum Term |

|---|---|---|---|

| Bronze | Powertrain only: engine, transmission, drive axle, cooling system basics | Newer vehicles with factory warranty still covering other systems | Varies by administrator |

| Silver | Powertrain plus: adds turbocharger, seals, gaskets, some electrical | Budget-conscious buyers who want slightly more than basic | Varies by administrator |

| Gold | Major systems: powertrain, steering, brakes, fuel system, electrical basics | Mid-mileage vehicles needing broader coverage | Up to 7 years |

| Platinum | Comprehensive stated component: adds suspension, A/C, high-tech features | Higher-mileage vehicles with electronic systems | Up to 10 years |

| Titanium | Exclusionary: everything except what's specifically listed as excluded | Highest mileage vehicles needing maximum protection | Up to 10 years |

The Devil’s in the Exclusions

Even CARCHEX's top-tier Titanium coverage—marketed as "exclusionary" and "closest to your car's factory warranty"—comes with significant exclusions that consumers discover only after reading the contract:

- No luxury/exotic brands: Alfa Romeo, Aston Martin, Bentley, Ferrari, Lamborghini, Land Rover, Lotus, Maserati, Maybach, McLaren, Peugeot, Porsche, Renault, and Rolls-Royce

- Standard maintenance: Oil changes, filters, brake pads, wiper blades, tire rotations

- Wear and tear items: Determined by administrator, often disputed

- Pre-existing conditions: Broadly interpreted

- Aftermarket modifications: Can void entire contract

More importantly, the contract you receive depends on which administrator CARCHEX assigns to your vehicle. The exclusions in an American Auto Shield Titanium plan may differ from those in a Royal Administration Services Titanium plan—even though they're both sold as "CARCHEX Titanium coverage."

The Real Cost of Complexity: CARCHEX Pricing

CARCHEX markets its coverage with phrases like "starting at $99 per month," which sounds reasonable. But what do customers actually pay?

Multiple independent reviews document actual CARCHEX pricing significantly above the advertised "starting" rate. According to Automoblog's 2025 review, "a CARCHEX warranty costs between $150 and $250 per month depending on your term length and payment plan." The Cars.com review found monthly costs "between $177 and $218 per month" for 18-month payment terms.

Total Cost Example

For a 2021 Ford Escape with 50,000 miles, CNBC Select received a quote of $191 per month for 24 months for a five-year Platinum policy. That's $4,584 total for the coverage period.

| Cost Component | Amount | Notes |

|---|---|---|

| Monthly Payment | $191 | For 24 months |

| Total Paid | $4,584 | 24 × $191 |

| Coverage Period | 5 years | After 24-month payment period |

| Waiting Period | 30 days + 1,000 miles | No coverage during this time |

| First 90 Days Deductible | $1,000 max | Higher early deductible |

| Standard Deductible | $0-$250 | Most components after 90 days |

| Major Component Deductible | $250-$500 | Engine/transmission replacement |

Now factor in potential out-of-pocket costs: if your claim is denied or partially covered, labor rate caps force you to pay the difference, or your preferred shop doesn't accept your administrator's payment terms. The complexity of the broker model creates multiple opportunities for unexpected expenses.

The BBB Rating Paradox: A+ Company, 1.91-Star Customer Experience

CARCHEX holds an impressive A+ rating from the Better Business Bureau and has maintained BBB accreditation since 2009. This suggests a company that takes consumer complaints seriously and works to resolve them.

But here's the paradox: CARCHEX's customer rating on the BBB is just 1.91 out of 5 stars based on customer reviews. How can a company be both A+ rated and poorly reviewed by actual customers?

This is the second hidden cost of the broker model: reactive rather than proactive quality. When administrators handle all claims, the broker can only react to disputes, not prevent them. CARCHEX's A+ rating reflects their responsiveness; the 1.91-star customer rating reflects the administrator-driven experience customers actually receive.

Why the Broker Model Exists: Industry Economics

To understand CARCHEX, you need to understand why brokers exist in the warranty industry.

In traditional warranty sales, dealers marked up administrator costs by 100-300%. A policy that cost the dealer $800 might be sold for $2,400. Brokers emerged as a "consumer-friendly" alternative, promising to shop multiple administrators and find the best deal. And compared to dealer markups, brokers often do offer better prices.

But brokers still add their own layer of cost and complexity:

- Commission Structure: Brokers earn a percentage of the premium paid to administrators, creating an incentive to sell higher-priced plans

- Reduced Accountability: When claims are denied, brokers can point to administrators; administrators can point to contract language; customers are caught in the middle

- Information Asymmetry: Customers don't know which administrator they'll get until after purchase, preventing true comparison shopping

- Administrative Overhead: Every claim requires coordination between customer, repair facility, broker, and administrator

According to FTC consumer guidance, vehicle service contracts are among the most complained-about financial products precisely because of these multi-party arrangements. The more entities involved between you and claims payment, the more opportunities for miscommunication, disputes, and denied coverage.

The Modern Alternative: Direct Provider Model

The warranty industry is splitting into two camps: those doubling down on complexity (brokers with multiple tiers and administrators) and those embracing simplicity (direct providers with straightforward coverage).

VIP Warranty For Life represents the modern alternative:

| Feature | CARCHEX (Broker) | VIP (Direct Provider) |

|---|---|---|

| Business Model | Broker selling for 8 administrators | Direct provider with insurance partner |

| Coverage Options | 20+ plans across 5 tiers | One exclusionary plan, choose annual limit |

| Who Handles Claims | Varies by administrator assigned | VIP directly |

| Contract With | Third-party administrator | VIP Warranty For Life |

| Payment Structure | Term-based ($150-$218/month typical) | Month-to-month subscription |

| Cancellation | 30-day full refund, then prorated | Cancel anytime, no penalties |

| Waiting Period | 30 days + 1,000 miles | 60 days |

| Deductible | $0-$500 depending on component | $300 first 6 months, then $0 |

| Mileage Limit | Up to 250,000 miles | Up to 250,000 miles at enrollment |

| Inspection Required | No | No |

| Price Increases | Set at purchase | Maximum 5% annually |

| Key Difference | Complexity, choice, broker layer | Simplicity, directness, transparency |

The direct provider model eliminates the broker layer entirely. You pay one company, that company handles your claims, and if there's a problem, you know exactly who to hold accountable. No wondering which administrator has your contract. No discovering after a claim denial that the fine print in your specific administrator's version of the plan excludes what you thought was covered.

When CARCHEX Makes Sense

Despite the complexity we've documented, CARCHEX isn't the wrong choice for everyone. Here's when the broker model might work in your favor:

You Have a Luxury Vehicle

If you own a high-end European vehicle (excluding the exotic brands CARCHEX won't cover), their Platinum or Titanium plans through certain administrators may offer better coverage for expensive electronic systems than basic direct provider plans. The complexity becomes worth navigating if you're protecting a $60,000 BMW with $8,000 in potential electronic repairs.

You Value Provider Shopping

Some customers appreciate having CARCHEX shop their vehicle to multiple administrators, even if they don't control which one is ultimately selected. If you believe the broker's access to multiple providers increases the chance of approval for a difficult-to-insure vehicle, this model may appeal to you.

You’re Comfortable Reading Contracts

CARCHEX does provide sample contracts online for each plan type—a transparency practice many brokers skip. If you're willing to carefully read the specific contract from your assigned administrator before committing, you can make an informed decision about whether the coverage meets your needs.

You Want Term-Based Financing

CARCHEX offers 24-month payment plans that spread the cost over a predictable term. If you prefer knowing your total financial commitment upfront rather than open-ended monthly subscriptions, this structure might suit your budgeting style better.

Frequently Asked Questions About CARCHEX

The Bottom Line on CARCHEX

CARCHEX is a legitimate, long-established broker with industry partnerships and a genuine commitment to resolving customer complaints (hence the A+ BBB rating). They offer access to multiple administrators, numerous coverage options, and competitive pricing compared to dealer markups.

But legitimacy doesn't equal simplicity, and complexity has real costs:

- Hidden cost #1: You don't know which administrator you'll get until after committing

- Hidden cost #2: Each administrator has different claims practices, labor rates, and interpretations

- Hidden cost #3: When disputes arise, accountability is split between broker and administrator

- Hidden cost #4: The ownership connection between CARCHEX and AAS (the FTC settlement co-defendant) raises questions about claims practices

- Hidden cost #5: Comparing 20 plans across 8 administrators requires expertise most consumers lack

The warranty industry is evolving toward simpler, more transparent models. Companies like VIP Warranty For Life demonstrate that consumers don't need 20 plans and 8 administrators to get comprehensive coverage. One exclusionary plan, month-to-month pricing, and direct claims handling can provide better protection with less confusion.

If you're considering CARCHEX, ask yourself: Do I want to navigate the complexity of multiple administrators for potentially broader options? Or do I value simplicity, direct accountability, and knowing exactly who handles my claims?

There's no universally right answer—but there is a right answer for you. And that answer should be based on full information about what you're actually buying, not marketing promises about "starting at $99/month."